How to Determine Which Depreciation Method Must Be Used

You can define the following types of depreciation methods. Calculates the annual depreciation using the depreciation method and life to determine which rate table to use.

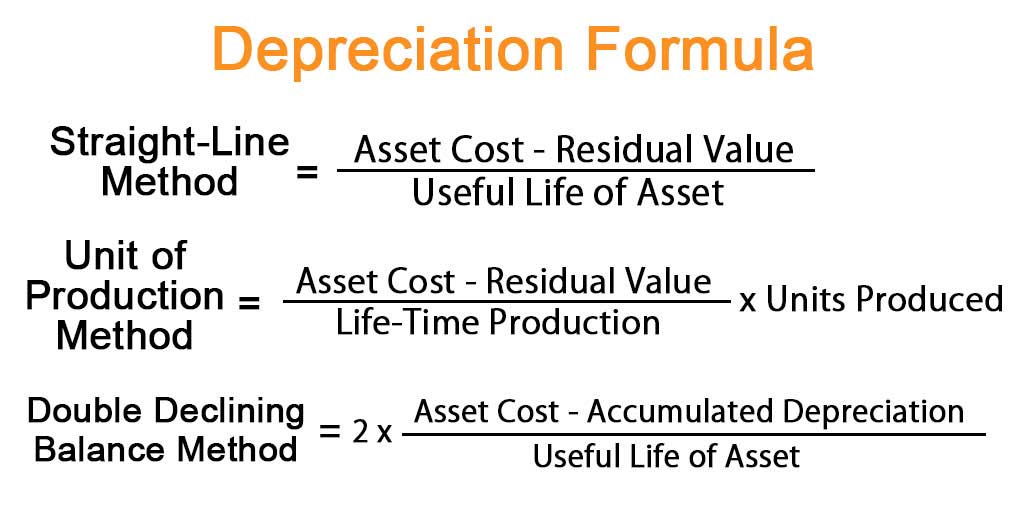

Depreciation Formula Calculate Depreciation Expense

25000 - 50050000 x 5000 2450.

. How Do You Calculate Depreciation. In this method the depreciation calculated is divided over the useful. Amortization and depreciation are both used to calculate the value of assets over a period.

The first two. If your asset is a machinery or plant that works best during the initial years of its useful life and loses its capacity over time then you should use the reducing balance method. Provision for depreciation Ac is not maintained.

On 2 January 20X5 Open Safari acquires a second property Sealands in Africania for 2000000. You should choose depreciation methods depending on how you choose to use the asset. Calculated methods spread the asset value evenly over the life of the asset.

Methods of recording Depreciation. You must generally use GDS unless you are specifically required by law to use ADS or you elect to use ADS. It is the most commonly used method of depreciation.

Divide this amount by the number of years in the assets useful lifespan. 20X5 to 20X8 After living in Africania for about five years the Bilkersens are further inspired by its potential as a showcase for wildlife. Calculating depreciation can be straightforward or more complicated depending on the method employed.

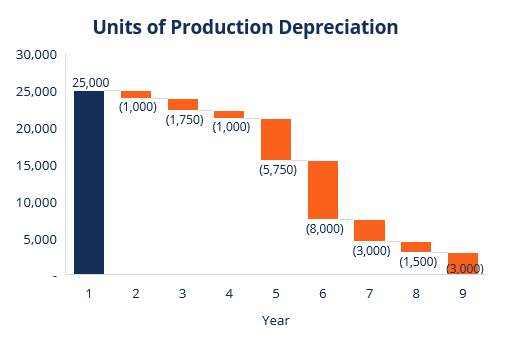

As mentioned above the straight-line method or straight-line basis is the most commonly used method to calculate depreciation under GAAP. Total depreciation Cost Salvage value. The units-of-production method of depreciation does not have a built-in Excel function but is included here because it is a widely used method of depreciation and can be calculated using Excel.

Taking depreciation expenses each year is a way to reduce your business tax bill. Depreciation is handled differently for accounting and tax purposes but the basic calculation is the same. O How to determine which depreciation method must be used.

That is the depreciation cost per hour of use. The companies must prepare. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

Determine Which Type of Depreciation Method to Use There are four methods to choose from. Asset Disposal Ac is not opened. Divide by 12 to tell you the monthly depreciation for the asset.

The Modified Accelerated Cost Recovery System MACRS is used by the IRS to calculate depreciation by the Straight-line method and declining balance method. Accelerated depreciation Accelerated Depreciation Accelerated depreciation is a depreciation method in which a capital asset reduces its book value at a faster accelerated rate than it would is used by many companies and looking at historic corporate data the depreciation method creates proportionally large corporate tax expenditures. Difference between depreciation and amortization.

Provision for depreciation Ac is not maintained. 4 more depreciation methods and 2 examples. Understand the Depreciation Variables As you prepare to calculate depreciation you need to be familiar with the.

Asset Disposal Ac is opened. So let us study the methods of calculating depreciation in detail. If the company used the car for 2000 hours this year that value would be multiplied by the per hour depreciation of 018 to get 360.

Companies must take into account the rate at which each block is depreciated as per the income tax guidelines. Asset cost - Expected salvage value Expected years of use. In this method the depreciation is charged more in the early years of the asset and the depreciation amount.

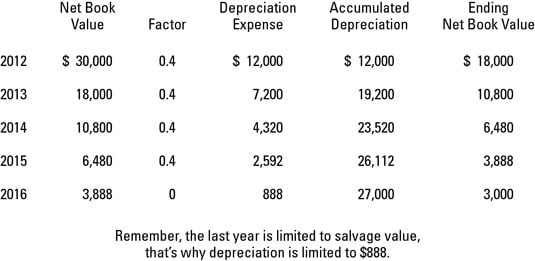

Monthly depreciation 12005 12 20. You can calculate accumulated depreciation using straight-line or declining balance methods. There are several methods for calculating depreciation and in some circumstances the Internal Revenue Service IRS or other outside groups may require businesses to use a specific one.

What You Must Know to Calculate Depreciation. Asset cost - salvage valueestimated units over assets life x actual units made. 369000 property cost basis 275 years 1341818 annual depreciation expense.

Divide 18000 by the 100000 hours of estimated life that the car has leaving you with 018. There are two methods of recording depreciation. Provision for depreciation Ac is maintained.

The basic formula for determining accumulated depreciation is. 100useful life x 2 OR 200 useful life Residual Value is not used in. There are many methods of depreciation that comply with Generally Accepted Accounting Principles GAAP though the most commonly used is the straight-line depreciation method which offers the simplest most straightforward way.

The straight-line depreciation method is the most commonly used and easiest way to calculate depreciation. First subtract the assets salvage value from its cost in order to determine the amount that can be depreciated. Your use of either the General Depreciation System GDS or the Alternative Depreciation System ADS to depreciate property under MACRS determines what depreciation method and recovery period you use.

This method is also the simplest way to calculate. Annual depreciation Total depreciation Useful lifespan. Calculate Rental Property Depreciation Expense.

The straight-line method of depreciation is the most simple and easy to use depreciation method. Sum of years method. Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

It is calculated on the reducing balance method on a block of assets. O How to determine the residual value. ABCs depreciation expense is 2450.

The formula is cost salvage useful life in units units produced in period. Calculates the annual depreciation rate by dividing the life in years into one. Straight-line is the primary formula while declining balance represents longer-term depreciation.

O How to determine the useful life. Monthly depreciation Annual deprecation 12. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Cost Accumulated Depreciation Declining Balance Rate OR Book Value Declining Balance Rate Rate Double the straight-line method rate. It is also called the Original cost method Fixed Installment method or Equal Installment method.

No comments for "How to Determine Which Depreciation Method Must Be Used"

Post a Comment